TDA - one of the three largest coated steel enterprises in Vietnam - is planning to raise capital through IPO and stock listing on HOSE. Internal shareholders and the related parties are holding more than 2/3 of the company's authorized capital.

According to SSI, Ton Dong A Corporation (TDA) will do initial public offer (IPO) in the upcoming November, including 12.37 million primary shares and 2.98 million secondary shares, respectively 12% and 3% of authorized capital before the offering.

If succeed, the total of outstanding shares will increase from 102.32 million units to 114.69 million units. Ton Dong A is planning to list the shares on HOSE in January, 2022.

Ton Dong A focuses on coated steel in the Southern and foreign markets. Founded in 1998, Ton Dong A specializes in producing cold rolled steel, galvanize, galvalume, pre-paint galvalume steel used in industrial and civil construction, transportation infrastructure, household appliances ....

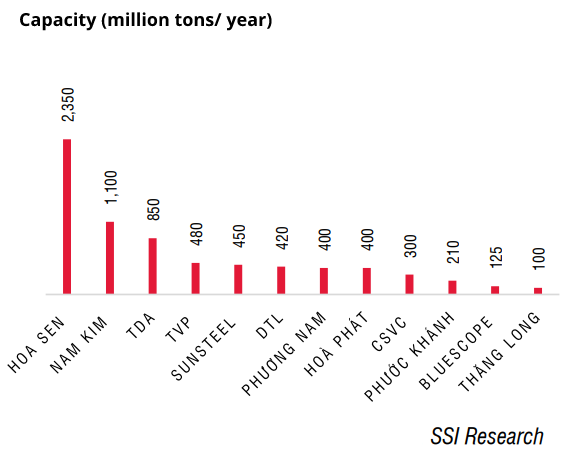

TDA has two factories in Song Than 1 and Dong An 2 industrial park in Binh Duong province, with an annual capacity of 850,000 tons

In 2020, Ton Dong A sold over 630,000 tons of coated steel domestically and internationally; gained 16% of the market share and ranked second after Hoa Sen Group (Code: HSG). Within the first 8 months of 2021, TDA has sold about 500,000 tons, approximately 14.7% of the market share, after to only Hoa Sen and Nam Kim (Code: NKG).

Total consumption of coated steel through the months of 2021 (thousand tons) and enterprise market share

SSI has estimated the total consumption of TDA in 2021 to be increased 17% compared to previous year. In particular, the foreign market is the main motivation, with the expected exporting output to increase 152% while domestic consumption is said to drop 44% under the impact of the COVID-19 pandemic and strict social distancing.

The proportion of export volume to total consumption of Ton Dong A increased from 33.33% in 2020 to 61% in the first eight months of this year, according to the data from the Vietnam Steel Association (VSA). Ton Dong A's domestic market share decreased from 18.2% to about 15%. Ton Dong A holds 14.8% market share of domestic coated steel (excluding export).

.png)

According to SSI, Ton Dong A has 10 major general agencies, 100 1st level agencies and more than 900 2nd level agencies across the country. The company also has more than 25 regular B2B distributors that consume over 1,000 tons/month, more than 600 B2C dealers with a purchase volume of over 500 tons/month and more than 40 pre-engineered steel customers.

TDA's largest market is the Southern region with an output of more than 160,000 tons in the first 8 months of this year, accounting for 19.5% of the market share in the South and over 32% of Ton Dong A's total sales.

Forecasting a new peak of profit

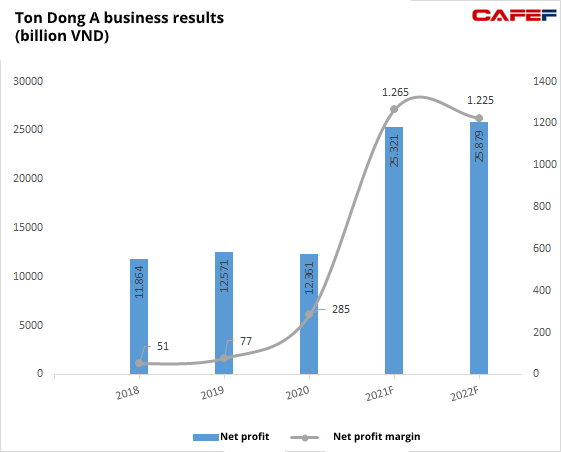

The gross profit margin is estimated to improve from 7.4% in 2020 to 10.3% this year by the uptrend of steel price. The company has taken advantages of cheap inventory, especially in the first half of 2021.

Improved operating results also come from higher expected selling prices for European and North American markets. SSI estimates in 2021 Ton Dong A's revenue and profit after tax can reach VND 25,300 billion and VND 1,260 billion, respectively increase 105% and 344% compared to previous year and are the highest in history.

In the first 6 months of this year, the company recorded a net profit of VND 618 billion, 117% higher than 2020.

Concentrated shareholder structure

SSI states that founders, management and other shareholders control 68% of Ton Dong A's total outstanding shares. Mr. Nguyen Thanh Trung, Chairman of the Board of Directors and founder of Ton Dong A, has been with TDA continuously since 1998. Investors own 23.6% shares,.

JFE Holdings is the supplier of about 20-30% of the value of hot rolled coil (HRC) that Ton Dong A uses to produce coated steel, the credit period is eased within 90 - 120 days and the price is more stable than the market’s.

Formosa Ha Tinh is the biggest supplier of HRC, accounting for 30-40% of the company's input. Other main sources of HRC include many foreign companies such as Nippon, Bao Steel, Kobe and Posco.

HRC usually accounts for about 80% of the production cost of coated steel, so the fluctuation of HRC price will significantly affect cost of goods sold (COGS), SSI commented.

Ton Dong A and other domestic flat steel producers can usually pass some of the increased HRC prices on to customers, but strong price fluctuations (especially falling prices) will make it difficult for companies to manage inventory and ensure profit margins.